File your Goods and Services

Tax - GST Return Online

Starting from 1,770/- per month

Important Points

- Manages all invoices with proper accounting.

- Filing of all GST return, invoices.

- Use of technology to ease your process.

GST Return Filings Online

Know what is GST? and How the return filing procedure takes place?

What is a meaning of Goods & Services Tax (GST) Return?

GST return are documents which are filed with the GST department stating every information which is required under the law. Further, every registered person shall need to file the GST return online and which is recommended via software. If your turnover is more than 20 lakh, then you need to get registered and file 3 monthly GST return (GSTR 1, 2 and 3)

How to file GST return online in India?

Filing of GST return is not a simple task rather it is a very complicated procedure. Hence, one should purchase a software to file the GST return online. Basically, there are three steps to file the GST return online:

# Upload invoices before making supply: As per GST law, every registered person need to upload the invoices on the GST portal against which they will be issue invoice reference number. Once invoices are properly uploaded on the GST portal or the software, then we can proceed to next step.

# File GSTR 1, GSTR 2 & GSTR 3: Once invoices are uploaded on the software, you need to file the 3 GSTRreturn online, i.e. Outward return, Inward return and cumulative monthly return. After filing, if there is any error, then you must correct it and refile the return.

# Matching of Return: Under GST, each return is matched with another return and if there is any difference, they you must edit, modify and correct it.

Know the basics

Learn the basics about GST registration & its compliance

Get all information by email

Information sent to your email !

Documents Required for Online GST Return Filing in India

For GST return filing, there is no formal set of documents required. The GST returns shall be completely dependent upon the invoices created under GST. Hence, creation of invoices shall serve as base for filing the GST return in India.Further, to file the GST return, you must follow a standard guidelines:

- Prepare each and every invoice as per the GST law.

- Further, each product shall be categorized as per the HSN code.

- Try to maintain invoices details in a format given in the GST software.

- Once invoices are uploaded, you can easily file the monthly returns.

GST Monthly Return Filing Procedure

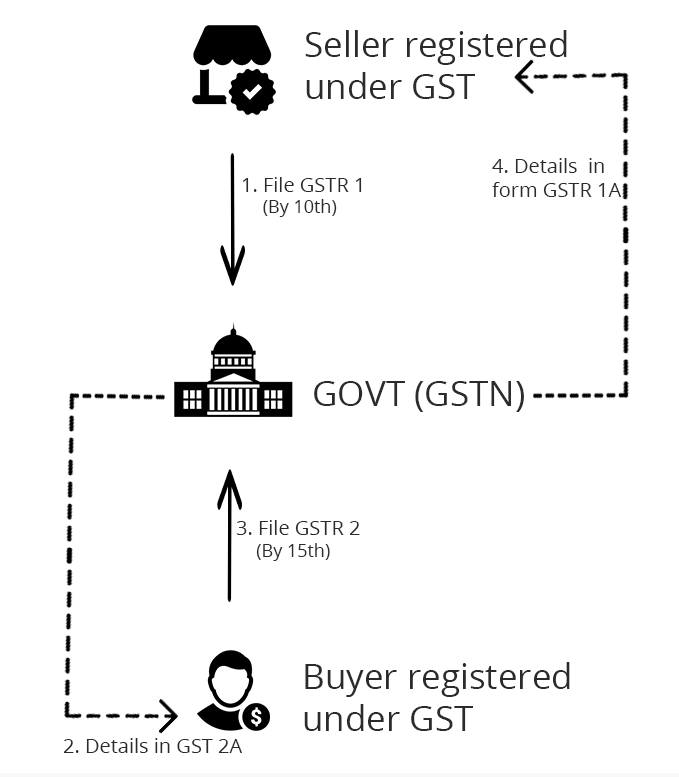

GST monthly return filing is a little complex task as matching and reversal task are also involved under GST return filing procedure. If there is any discrepancy in filing between seller and buyer, then the same has to be reconciled. Let us understand the full procedure:

# Step 1 :The person shall file the outward supply return in GSTR 1 before tenth of the month succeeding the said tax period.

# Step 2 :Details of outward supplies furnished by the supplier shall be made available to the recipient in FORM GSTR 2A.

# Step 3 :Recipient shall verify, validate, modify the details relating to outward supplies and may also file details of credit or debit notes.

# Step 4 :After verification, recipient shall furnish,the details of inward supplies of taxable goods and /or services in FORM GSTR - 2.

# Step 5 :The details of inward supplies by the recipient shall be made available in FORM GSTR-1A and supplier may either accept or reject the modifications.

# Step 6 :If the details provided remained unmatched, then the person shall rectify such error or omission in the tax period during which such error is noticed.

Time & Cost for GST Return Filing

Who should choose this plan?

For startups and micro business who want to outsource only GST compliance as Accounting is not required for them.

Book Now at

just

1,770/- per month

Note: Even if you have zero transactions, the return filing under GST is mandatory. If you don’t file the return, then there is a penalty of Rs.100 per day.

What all you get in this plan?

The GST compliances are very complex & stringent and therefore, we take the complete care of all GST compliances.

- Filing of three Monthly returns.

- Creation of invoices.

- Uploading of each invoice to govt.

- Creation of invoices.

- Preparation of Purchase and Sales register.

- GST tax calculation with HSN Code.

- Auto charging of CGST, SGST, IGST.

- Preparing and Filing ITR.

- Managing everything through software.

- Separate login & Reporting system.

Types of GST Returns and their due dates

There are various returns to be filed under GST law. The most common are GSTR 1, GSTR 2 and GST 3, because they need to file them monthly.

| Types | Details about GST Return | By When? | By Whom? |

|---|---|---|---|

| GSTR - 1 | Outward return (Details about your sales/ Supplies made during month) | 10th of next month | Registered person except few |

| GSTR - 2 | Inward return (Details about your purchases made during month) | 15th of next month | Registered person except few |

| GSTR - 3 | Month return (for cumulative records of inward and outward made during month) | 20th of next month | Registered person except few |

| GSTR - 4 | A return by Composite dealer (a person availing such service with supplies < Rs. 50 lakh) | 18th of next quarter | Composite dealer only |

| GSTR - 5 | Monthly return by Non resident taxable person | 13th of next month | Registered non resident |

| GSTR - 6 | Monthly return by input service distributor | 13th of next month | Input service distributer |

| GSTR - 7 | Person who are required to deduct TDS | 10th of next month | Prescribed persons |

| GSTR - 8 | E-commerce market places who are required to deduct TDS | 18th of next quarter | Registered person except few |

| GSTR - 9 | Annual Return | 31th of next year | Every Registered Person |

Mandatory Requirements for GST Return Filing Online

As we all know that compliances under GST are more complex than ever before. Each month, company needs to file at-least three returns monthly. Further, each and every invoice shall be uploaded on the GSTIN portal. Hence, the mandatory requirements for GST return filings are as follows:

- You need to prepare a complete details of all purchases made during the month which is to be filed by 15th of the month.

- You need to prepare a complete details of all sales made during the month which is to be filed by 20th of the following month.

Compulsory/Mandatory Registration under GST

This is one of the most important information if you are planning to get GST registration. If you fall any of the category below that you need a compulsory GST registration irrespective of your turnover. E.g. if you fall in any category below, then your turnover is Rs.10 only then also you need to take the GST registration.

Here are 12 cases where GST registration is compulsory/mandatory irrespective of GST registration.

Person making any inter state taxable supply.

Casual taxable person making any taxable supply.

Persons who are required to pay tax under Reverse Charge.

Non resident taxable person making any taxable supply.

Persons who are required to pay tax under Reverse Charge.

Persons who are required to deduct TDS (Govt Departments).

Person supplying goods/services on behalf of someone else (agent).

Input service Distributor - Whether or not register.

Person selling on e-commerce platform like Flipkart, amazon etc.

Every e-commerce operator - Flipkart, amazon, snapdeal etc.

Every person providing online information database access from outside India - AWS, Godaddy etc.

Anything else notified by the Government from time to time.

Concept of Revised Return under GST

If any taxable person after furnishing a return discovers any omission or incorrect particulars therein, he may revised the return in the month in which such omission or incorrect particulars are noticed.

However, the two categories of people are not allowed to revise the returns which are as follows:

- Person required to deduct TDS

- Registered non taxable person

Revised return shall not be allowed after the due date for furnishing of return for the month of September or second quarter, as the case may be, following the end of the financial year, or the actual date of furnishing of relevant annual return, whichever is earlier.

Grow and Manage Your Business with Hubco's GST Software

Finally a GST software designed for the way you do work in a real life.

- CA, Tax consultant can manage unlimited number of clients

- You can upload all your invoices in a single go

- Filing of returns on a single of a button

- Automatic invoice generating and managing software

- Free Mobile application (Under Process)

- CA Assisted plans with experts advises

- Free Website with our plan versed with latest technology (Only for CA, CS)

Do Everybody needs a GST Software?

Its a question asked by almost every person who are still wandering about the GST. There is no such compulsion that every person needs to filed the GST software. However, since there are so much complexities in the GST regime GST software is recommended to every person.

Here are the following reasons as to why GST software is required and why free GSTIN is off no use:

- Under GST, each and every invoice is to be uploaded and looking at quantum of invoices raised, it will not be possible to upload each invoice everyday. But under GST software, you shall be able to upload all invoices in one go.

- Under GST, each and every buy sell is to be reconciled and between thousands of line items it is very difficult to search where non reconciliation happens. But under GST software, it automatically specify the line items which are not reconciled.

- Under GST software, we also help you to generate invoices directly from the software and you can even connect the software from tally, busy, SAP or any other accounting software.

See what our customer has to say about Hubco.in

"You have solved my years back problem of micro finance in a span of 5 minutes. Great Service!"

Keep it up team! - Rajeev Rustogi

GST Return filing for E-commerce and its Sellers

For E-commerce - Flipkart, Amazon

Every e-commerce players need to register under GST, mandatory irrespective of the turnover of the company.

Further, every registered e-commerce venture shall collect at source on the payment of it's sellers and deposit the same to the government.

Accept loan from from its directors.

Can issue shares at premium and raise funding at high value even from public.

For Sellers on Flipkart / Amazon

Sellers on e-commerce are treated as a normal taxable person however, they need to register with GSTIN mandatory.

They need to file three monthly returns in GSTR 1, 2 & 3.Further, any TCS collected by the e-commerce platform shall be given due credit to the seller.

They also need to upload each and every invoice on the GSTIN portal.

Hence, they must use GST software.

Advantages & Disadvantages of GST return filing software

Advantages of GST Return filing

All online compliances.

Can upload all invoices in one go.

You can check refund status etc.

Filing of GST return in one go.

Disadvantages of GST Return filing

Monthly recurring cost of Rs.300 to 400

Stringent penalties

Dependence upon GST software

3 Monthly returns

FAQs about Goods & Services Tax (GST)

Q. What is Casual Taxable Person?

“Casual Taxable Person” means a person who occasionally undertakes transactions involving supply or acquisition of goods and/or services in the course or furtherance of business whether as principal, agent or in any other capacity, in a taxable territory where he has no fixed place of business.

Q. I am a Small Dealer, not Registered under VAT or Not having TIN, Do I need to Register under GST?

No, If you are a small dealer and does not have a VAT / TIN number, you do not require to register under GST. GST migration right now only mandatory for those persons who are currently registered under ay statute including Service TAX, Sales Tax, Excise.

If you want to register under GST as a fresh dealer then you need to wait till July 2017, hopefully, GST will get live in the second quarter of 2017.

You can contact us for GST registration in India.

Q. I am a Service Provider, Registered in Service Tax, How I will get registered under GST?

For Service Providers, registered under Service Tax, the GST migration will start from 1st January 2017. Those who are registered under Service Tax or in Central Excise can able to migrate themselves in GST System. The drive for them will starts from 1st Jan 2017 and valid till 31st Jan 2017.

You can contact us for GST registration in India.

Why choose Hubco for GST Return Filing in India?

Customer

Satisfaction

Transparent & Lowest

Price

Great After

Sale Service